Prepare for the Future with a Retirement Plan

It’s Time to Think About What You’re Going to do.

You’ve been working for the man for several decades and now you’re slowly approaching retirement age. Start early and plan for your future by looking into indexed annuities as part of your retirement financial plan with the help of Stellar Insurance Services, Inc.

Retirement Planning Services

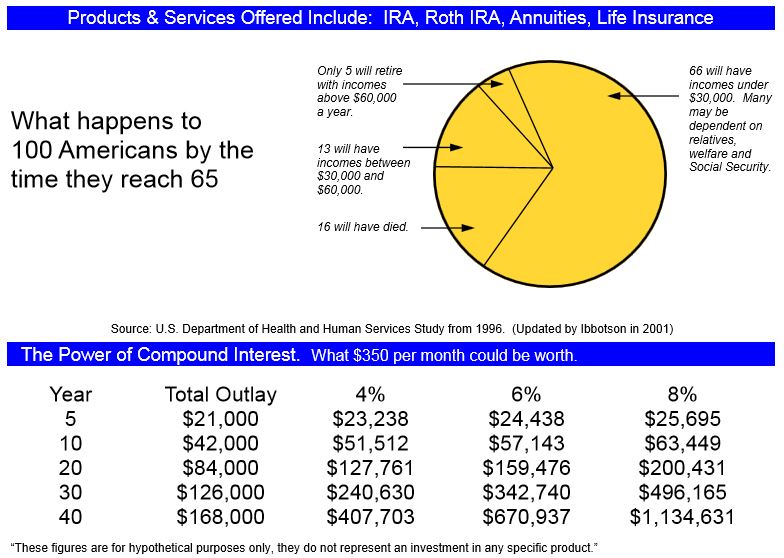

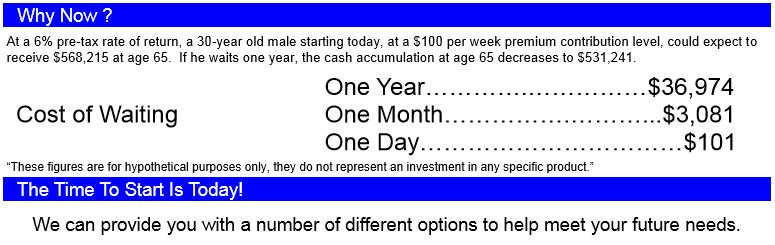

You can depend on a concerned retirement advisor to help you devise a plan that’ll work for you, your family, and your future. Whatever you do, creating a retirement plan is crucial, and not having a plan will hurt your over time.

We can advise you on how you can structure an indexed annuity, for example, as a traditional IRA, or ROTH IRA. If you’re disabled and unable to physically travel to our office, we can make a house call. Contact us today to schedule your appointment and talk to us about why we think indexed annuities are one of the intelligent ways to plan for your retirement.

Quick contact form.

Please use the form below to get in touch with us. we are happy to answer any questions to help you decide the right insurance plan for your needs.

Investing Options

IRAs have long been a great way to plan for retirement. There are currently two types of IRAs – Traditional and ROTH.

Traditional IRAs allow for tax-deferred savings by allowing you to invest pre-tax dollars that are taxed upon withdrawal at your then current income rate. In some cases this may be a preferred method as your income at retirement will likely be lower, calculating your tax bracket at retirement to be lower.

ROTH IRAs are basically the opposite of Traditional IRAs. You invest after-tax dollars and the investment grows tax-free. There are typically no additional fees upon withdrawal as the taxes have already been paid before investment. Some people prefer ROTH IRAs because income tax rates have traditionally risen more often than not – thus paying the taxes now, are a smaller portion of the money, may result in fewer taxes overall.

Annuities

Annuities – sometimes referred to as “upside down insurance policies” may be a great addition to your retirement planning strategies. Because they can be structured as Traditional and ROTH IRAs, annuities can be structured to offer a higher rate of return without the risk of investing directly into the stock market.